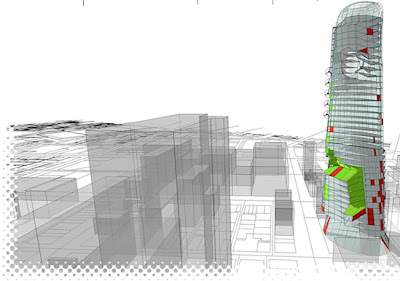

Andrew has a unique and fun style in his designs, mixing the functionality of his ideas with the creative and original spark. He seems to look at architecture in a more of a product design with hundreds of fun and creative concepts to his name.

zaha hadid

Andrew has a unique and fun style in his designs, mixing the functionality of his ideas with the creative and original spark. He seems to look at architecture in a more of a product design with hundreds of fun and creative concepts to his name.

zaha hadid

ARTICLE

Australian industry steels for new era

Win-win consolidation. Photo: Craig Abraham

THE steel industry has completed a major rationalisation, with the competition watchdog allowing the merger of OneSteel and Smorgon Steel, and BlueScope Steel's acquisition of a key Smorgon business.

The Australian Competition and Consumer Commission said it would not oppose the $1.1 billion merger between OneSteel and Smorgon, respectively the country's second and third-biggest steel producers.

Both make and distribute steel long products in Australia, such as steel rod and bar, wire, pipe and tube.

The ACCC will also allow BlueScope, the nation's largest steel maker, which dominates the flat steel market, to buy Smorgon's distribution arm for $700 million.

The watchdog's conditions also require OneSteel to compensate importers that have incurred expenses or losses as a result of OneSteel's unsuccessful anti-dumping applications.

This provision will be in place for at least five years, and an independent expert will be appointed if OneSteel wants to challenge any claims.

ACCC chairman Graeme Samuel said the merged entity was likely to face strong competition from the importation of steel long products, as long as speculative anti-dumping applications did not disrupt the supply of imported products.

"The ACCC has formed the view that undertakings accepted by the ACCC will ensure that import competition is not impeded by speculative anti-dumping applications," he said.

Smorgon expects to send details of the deal to shareholders before the end of June, with a shareholder meeting to be held before the end of July.

The ACCC's action ends more than a year of protracted activities. OneSteel made a $1.6 billion offer for Smorgon last June, but BlueScope mounted a market raid in August and grabbed a 19.9 per cent stake to stop the takeover and gain a seat at the table.

Smorgon managing director and chief executive, Ray Horsburgh, who will now retire, said the outcome was good.

"The value to the Smorgon shareholders is very good," he said.

"They're going to get something like $2.70 a share, which is an outstanding return for them.

"I think the OneSteel share price is going to be very good, because it's going to be a very sound company.

"It's lowly geared, it's only 40 per cent gearing."

BlueScope and OneSteel were spun out of the old BHP steel division several years ago. Smorgon is BlueScope's second-largest domestic customer.

Smorgon shares closed 2¢ higher at $2.71 and Blue- Scope was up 9¢ to $10.75.

However, OneSteel fell 5¢ to $6.59 SITE VISIT with sophie trist and david shanasy

The first picture shows a Concrete UC connection to a steel UB. Secured by a ridgid plate and screw system. You can also see the floor joists running perpendicular to the UB with a steel sheet (concrete) floor

The second picture shows tempory framing to hold the UC in place whilst in construction

The first picture shows a Concrete UC connection to a steel UB. Secured by a ridgid plate and screw system. You can also see the floor joists running perpendicular to the UB with a steel sheet (concrete) floor

The second picture shows tempory framing to hold the UC in place whilst in construction